Exceeding Expectations – One Home at a Time.

- wespruss

Both Alexa and Deb provided excellent advice and service. We were extremely impressed with their knowledge of the market, tireless work ethic and overall professionalism and business acumen.

We will definitely recommending them to all our friends and relatives.

Both Alexa and Deb provided excellent advice and service. We were extremely impressed with their knowledge of the market, tireless work ethic and overall professionalism and business acumen.

We will definitely recommending them to all our friends and relatives.

October 6, 2021Nancy Hyland We called Alexa after seeing her listing in Palm City. Not only did she know the house and the owners, but she lives locally. She was able to provide us with a detailed list of service providers. Since we are not local (yet) she and Deb are godsends to us while we are out of state! They keep…

We called Alexa after seeing her listing in Palm City. Not only did she know the house and the owners, but she lives locally. She was able to provide us with a detailed list of service providers. Since we are not local (yet) she and Deb are godsends to us while we are out of state! They keep…

February 1, 2021ldeanlyb I tried to sell my home myself before enlisting the help of Alexa. Even in a seller’s market, I was unable to get ANY interest at my asking price. That’s when I turned to Alexa for help. She came highly recommended by numerous neighbors, so I gave her a call. Her professional, experienced…

I tried to sell my home myself before enlisting the help of Alexa. Even in a seller’s market, I was unable to get ANY interest at my asking price. That’s when I turned to Alexa for help. She came highly recommended by numerous neighbors, so I gave her a call. Her professional, experienced…

January 16, 2021 - mac5821

Alexa provided valuable advice when deciding if we wanted to sell our home and purse the purchase of another home. We had a very precise need and I classified the two deals as “if the stars align” and low and behold Alexa aligned the stars for us! Within 3 days we had 3 offers on the sale of our…

Alexa provided valuable advice when deciding if we wanted to sell our home and purse the purchase of another home. We had a very precise need and I classified the two deals as “if the stars align” and low and behold Alexa aligned the stars for us! Within 3 days we had 3 offers on the sale of our…

January 13, 2021joannmignano Alexa Silva helped me sell my home and then found me another home to start my new chapter. She is an amazing relator with so much knowledge. She made the whole process stress free!

Alexa Silva helped me sell my home and then found me another home to start my new chapter. She is an amazing relator with so much knowledge. She made the whole process stress free!

January 13, 2021uffontani Alexa was the best realtor i have ever worked with. Every detail from prepping, staging and listing was poured over by Alexa and Jen. My house sold right away, which was great, but the ease of the whole process was amazing. If you are buying or selling a house, i would highly recommend Alexa Silva….

Alexa was the best realtor i have ever worked with. Every detail from prepping, staging and listing was poured over by Alexa and Jen. My house sold right away, which was great, but the ease of the whole process was amazing. If you are buying or selling a house, i would highly recommend Alexa Silva….

January 6, 2021 - AGSLP3

Alexa is a Rock Star! She goes above and beyond in making sure both buyers and sellers are satisfied with their decisions when buying a house. Her team is awesome and easy to work with. I would definitely recommend Alexa and her team to anyone thinking about buying or selling their home!

Alexa is a Rock Star! She goes above and beyond in making sure both buyers and sellers are satisfied with their decisions when buying a house. Her team is awesome and easy to work with. I would definitely recommend Alexa and her team to anyone thinking about buying or selling their home!

January 4, 2021ptower17 Alexa was amazing! She made wonderful recommendations to us for the staging of our home in order for us to get the best offer possible, and to insure that our home would sell quickly. We did everything she recommended and had multiple offers within 48 hours of going on the market. She vetted all…

Alexa was amazing! She made wonderful recommendations to us for the staging of our home in order for us to get the best offer possible, and to insure that our home would sell quickly. We did everything she recommended and had multiple offers within 48 hours of going on the market. She vetted all…

September 10, 2020 - user42209

Alexa and Deb did a wonderful job every step of the way in the marketing and sale of our house. Both were knowledgeable, very professional and responsive to any questions which arose. I highly recommend using them for your real estate needs.

Alexa and Deb did a wonderful job every step of the way in the marketing and sale of our house. Both were knowledgeable, very professional and responsive to any questions which arose. I highly recommend using them for your real estate needs.

April 10, 2020hannahmay4213 Alexa works so hard for you whether you are buying or selling. She made finding and getting into our dream home a welcomed reality. The process was fun and so easy. Communication is key during such an important step as a new homeowner and she made everything move along smoothly, keeping us…

Alexa works so hard for you whether you are buying or selling. She made finding and getting into our dream home a welcomed reality. The process was fun and so easy. Communication is key during such an important step as a new homeowner and she made everything move along smoothly, keeping us…

April 9, 2019Carolyn May Alexa works so hard for you whether you are buying or selling. She made finding and getting into our dream home a welcomed reality. The process was fun and so easy. Communication is key during such an important step as a new homeowner and she made everything move along smoothly, keeping us…

Alexa works so hard for you whether you are buying or selling. She made finding and getting into our dream home a welcomed reality. The process was fun and so easy. Communication is key during such an important step as a new homeowner and she made everything move along smoothly, keeping us…

April 9, 2019 - kellyadiogo

Alexa is extremely professional, upfront and honest. She has a wealth of knowledge and contacts that helped us find our dream home. It was such a pleasure working with her and her team. Anytime we had a question or needed something she got back to us right away. She continues to check in with us,…

Alexa is extremely professional, upfront and honest. She has a wealth of knowledge and contacts that helped us find our dream home. It was such a pleasure working with her and her team. Anytime we had a question or needed something she got back to us right away. She continues to check in with us,…

January 29, 2019rlewisamt Perfection… that is the word that best describes our experience with Alexa Silva. From the time we first spoke with her about our intentions to upgrade to a home more suited to our desires and needs, she made us feel at ease. She took the reins and quickly moved forward, which created a momentum…

Perfection… that is the word that best describes our experience with Alexa Silva. From the time we first spoke with her about our intentions to upgrade to a home more suited to our desires and needs, she made us feel at ease. She took the reins and quickly moved forward, which created a momentum…

January 6, 2019 - loisdemarest

Alexa Silva has been the most efficient and caring person I have ever dealt with in business. I would recommend her to anyone who has a home to sell. I will never forget how smooth and rewarding this experience has been.

Alexa Silva has been the most efficient and caring person I have ever dealt with in business. I would recommend her to anyone who has a home to sell. I will never forget how smooth and rewarding this experience has been.

March 14, 2018trashzar I purchased several homes with Alexa and she does a fantastic job. Start to finish great communication. Always there to help. She has a great team. I would recommend her to anyone looking to buy/sell in Palm City

I purchased several homes with Alexa and she does a fantastic job. Start to finish great communication. Always there to help. She has a great team. I would recommend her to anyone looking to buy/sell in Palm City

March 14, 2018nealestate3 Alexa has helped me Sell and Purchase Homes on 2 different occasions in the last 3 Years. There is not a harder working, more Professional Realtor in the Industry. She truly has her finger on the pulse of the “Market” and offers multiple options to fit ones needs. She exceeded expectations at every…

Alexa has helped me Sell and Purchase Homes on 2 different occasions in the last 3 Years. There is not a harder working, more Professional Realtor in the Industry. She truly has her finger on the pulse of the “Market” and offers multiple options to fit ones needs. She exceeded expectations at every…

February 8, 2018

Meet Alexa

Alexa has the uncanny ability to deliver exactly what her clients want even when they are unable to precisely articulate their desires.

Her keen intuition combined with her encyclopedic knowledge of available homes, allows Alexa to find the ideal home for buyers.

Whether buying or selling, Alexa believes the client always comes first. She gives each client personalized attention and focus to expertly match buyers and sellers with the best solution that meets their needs and is within their financial comfort zone.

“I believe in treating my clients like family.” says Alexa. “I give each client the same honesty, respect, and support I would for my own family.”

Alexa is also well known for being quite assertive and an effective negotiator when it comes to meeting customers expectations.

| __________________________________________ |

OUR ZILLOW REVIEWS |

_______________________________________ |

| __________________________________________ |

LATEST NEWS |

_______________________________________ |

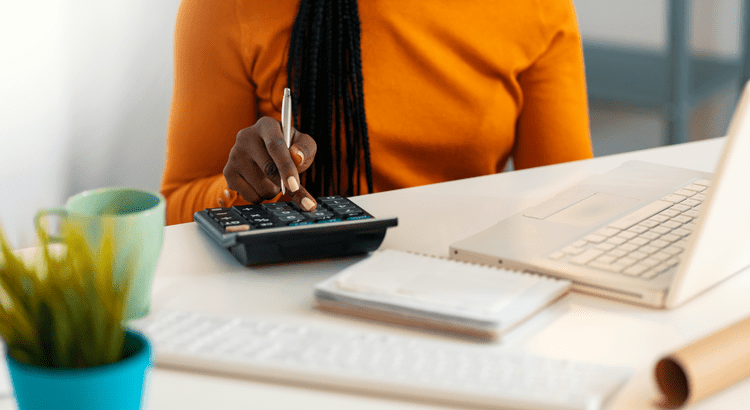

What To Save for When Buying a Home

Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process.

Here are just a few things experts say you should be thinking about as you plan ahead.

1. Down Payment

Saving for your down payment is likely top of mind. But how much do you really need? A common misconception is that you have to put down 20% of the purchase price. But that’s not necessarily the case. Unless it’s specified by your loan type or lender, you don’t have to. There are some home loan options that require as little as 3.5% or even 0% down. An article from The Mortgage Reports explains:

“The amount you need to put down will depend on a variety of factors, including the loan type and your financial goals. If you don’t have a large down payment saved up, don’t worry—there are plenty of options available . . .”

A trusted lender will go over the various loan types with you, any down payment requirements on those, and down payment assistance programs you may qualify for. The more you know ahead of time, the easier the process will be. And the key to getting the information you need is working with a pro to see what’ll work best for your situation.

2. Closing Costs

Make sure you also budget for closing costs, which are a collection of fees and payments made to the various parties involved in your transaction. Bankrate explains:

“Mortgage closing costs are the fees associated with buying a home that you must pay on closing day. Closing costs typically range from 2 to 5 percent of the total loan amount, and they include fees for the appraisal, title insurance and origination and underwriting of the loan.”

When it comes to closing costs, a trusted lender can guide you through specifics and answer any questions you may have. They can also give you a better idea of how much you should be prepared to pay so you can cruise through your closing with confidence.

And as you plan ahead for closing day, be sure to budget for your real estate agent’s professional service fee too, in case the seller doesn’t cover it. But don’t worry, you’ll work with your agent ahead of time to agree on what this is, so you won’t be surprised at the finish line.

3. Earnest Money Deposit

And if you want to cover all your bases, you can also consider saving for an earnest money deposit (EMD). According to Realtor.com, an EMD is typically between 1% and 2% of the total home price and is money you pay as a show of good faith when you make an offer on a house.

But, it’s not an added expense. Instead, it works like a credit and goes toward some of your upfront costs. You’re simply using some of the money you’ve already saved for your purchase to show the seller you’re committed and serious about buying their house. Realtor.com describes how it works as part of your sale:

“It tells the real estate seller you’re in earnest as a buyer . . . Assuming that all goes well and the buyer’s good-faith offer is accepted by the seller, the earnest money funds go toward the down payment and closing costs. In effect, earnest money is just paying more of the down payment and closing costs upfront.”

Keep in mind, this isn’t required, and it doesn’t guarantee your offer will be accepted. It’s important to work with a real estate advisor to understand what’s best for your situation and any specific requirements in your local area. They’ll advise you on what moves you should make so you can make the best possible decisions throughout the buying process.

Bottom Line

The key to a successful homebuying savings strategy? Being informed about what you need to save for. Because, when you understand what to expect, you can plan ahead. With an expert agent and a trusted lender, you’ll have the information you need to move forward with confidence.

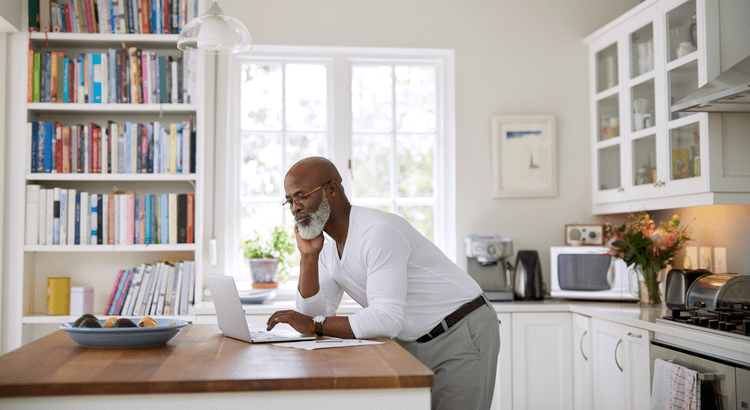

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance.

What Is Mortgage Forbearance?

As Bankrate explains:

“Mortgage forbearance is an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

A common misconception is that forbearance was only accessible during the COVID-19 pandemic. While it did play a significant role in helping homeowners through that crisis, what many people don’t know is that forbearance is still a tool to support borrowers in times of need. Today, it remains a vital option to help homeowners in certain circumstances avoid delinquency and, ultimately, foreclosure.

The Current State of Mortgage Forbearance

Forbearance continues to serve as a valuable safety net for homeowners facing temporary financial challenges. While the overall rate of forbearance has seen a slight increase recently, it’s important to understand what’s driving this change and how it fits into the broader picture.

According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

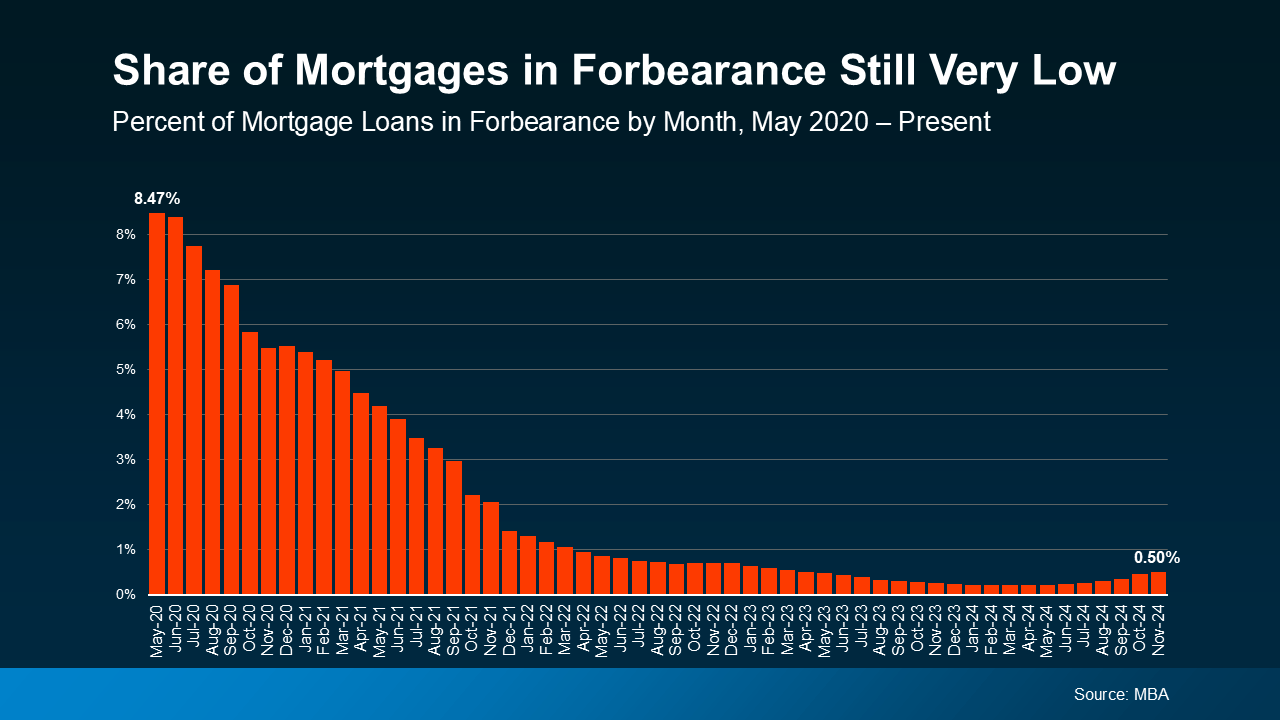

This may seem concerning at first glance, but let’s break it down. The graph below, going all the way back to 2020, puts things into perspective:

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

Natural disasters like these often create temporary financial hardships for homeowners, making forbearance a crucial safety net during recovery. In fact, 46% of borrowers in forbearance today cite natural disasters as the reason for their financial struggles.

Even with the most recent uptick, the share of mortgages in forbearance is nowhere near pandemic levels, and, thankfully, reflects a very small portion of homeowners overall.

Why Forbearance Matters

Forbearance can help borrowers avoid the spiral of missed payments and foreclosure. It provides breathing room to address challenges and plan next steps. And while most homeowners today are not in a position to need forbearance, thanks to strong equity and foundations of the current housing market, it is an option for the few who do need it.

If you or a homeowner you know is facing financial difficulties, the first step is to contact your mortgage lender. They can walk you through the forbearance process and help you understand your options. Keep in mind that forbearance is not automatic — you need to apply and discuss the terms with your lender.

Bottom Line

In tough times, knowing your options can bring peace of mind. Forbearance isn’t just a financial tool — it’s a lifeline. And while the recent increase in forbearance rates might make headlines that give you pause, the truth is this option is working exactly as it should: helping those who need it most get through difficult moments without losing their homes.

Expert Forecasts for the 2025 Housing Market

Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.

Experts are constantly updating and revising their forecasts, so here’s the latest on two of the biggest factors expected to shape the year ahead: mortgage rates and home prices.

Will Mortgage Rates Come Down?

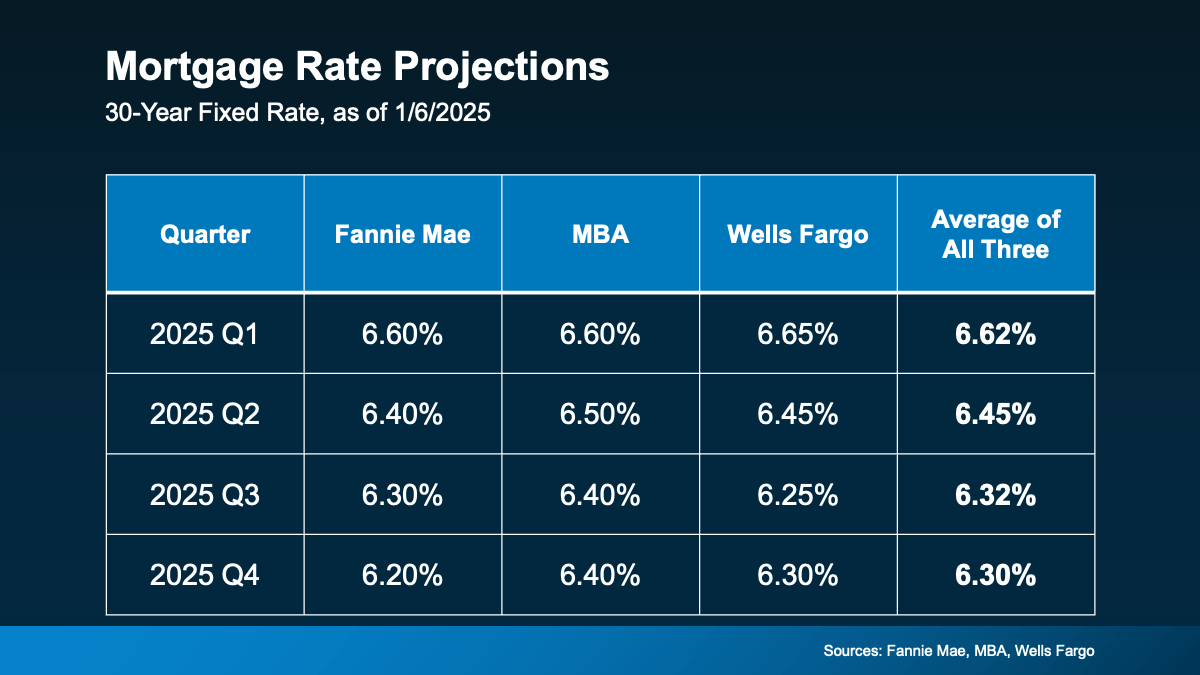

Everyone’s keeping an eye on mortgage rates and waiting for them to come down. So, the question is really: how far and how fast? The good news is they’re projected to ease a bit in 2025. But that doesn’t mean you should expect to see a return of 3-4% mortgage rates. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

And the other experts agree. They’re forecasting rates could settle in the mid-to-low 6% range by the end of the year (see chart below):

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

A trusted lender and an agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your bottom line. With their help, you’ll see even a small decline can help bring down your future mortgage payment.

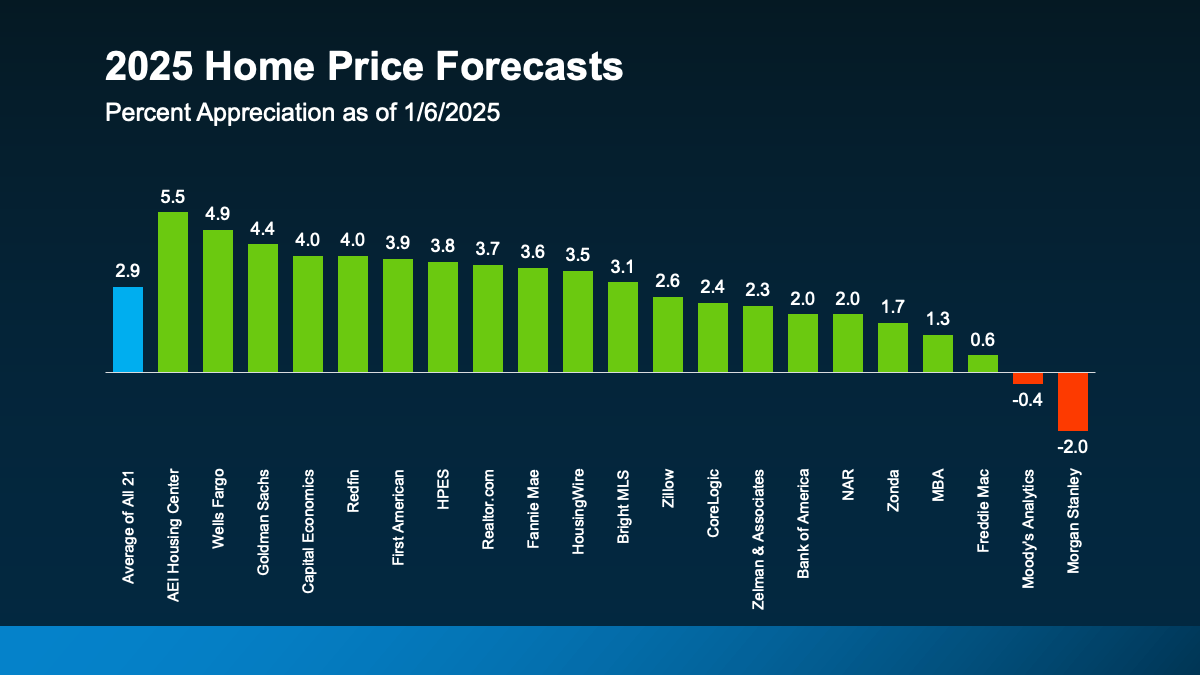

Will Home Prices Fall?

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – just at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. And that’s a much more typical and sustainable rise in prices (see graph below):

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

And if you’re wondering how it’s even possible prices are still rising, here’s your answer. It all comes down to supply and demand. Even though there are more homes for sale now than there were a year ago, it’s still not enough to keep up with all the buyers out there. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind, though, the housing market is hyper-local. So, this will vary by area. Some markets will see even higher prices. And some may see prices level off or even dip a little if inventory is up in that area. In most places though, prices will continue to rise (as they usually do).

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends and what they mean for your plans.

Bottom Line

The housing market is always shifting, and 2025 will be no different. With rates likely to ease a bit and prices rising at a more normal and sustainable pace, it’s all about staying informed and making a plan that works for you.

Reach out to a local real estate pro to get the scoop on what’s happening in your area and advice on how to make your next move a smart one.

| __________________________________________ |

Testimonials |

_______________________________________ |

“I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel”. Maya Angelou